Power Bank and the Federal Solar Tax Credit

Important: Project Solar does not offer tax advice. We recommend contacting a tax professional for full information on incentives.

As a company that specializes in low cost solar, we understand the importance of making renewable energy sources accessible and affordable to everyone. The Federal Solar Investment Tax Credit (ITC) is a great resource for homeowners to save money while helping the environment.

The ITC offers a 30% credit on the total cost of a solar panel installation, including qualified battery storage and any additional necessary equipment.

In 2022, the Inflation Reduction Act extended this credit until 2034, and edited the language surrounding battery backup to describe a “Qualified Battery Storage Technology Expenditure” as:

‘‘(A) is installed in connection with a dwelling unit located in the United States and used as a residence by the taxpayer, and

‘(B) has a capacity of not less than 3 kilowatt hours.’’

This means that batteries must be installed in connection with your home and have a capacity of 3kWh or greater to qualify for this credit--however, this also means that standalone batteries are eligible.

Our solution is the Expanded Home Backup Kit. This kit includes a Transfer Switch that is installed in tandem with your home’s electrical system, which can provide backup for 4 circuits.

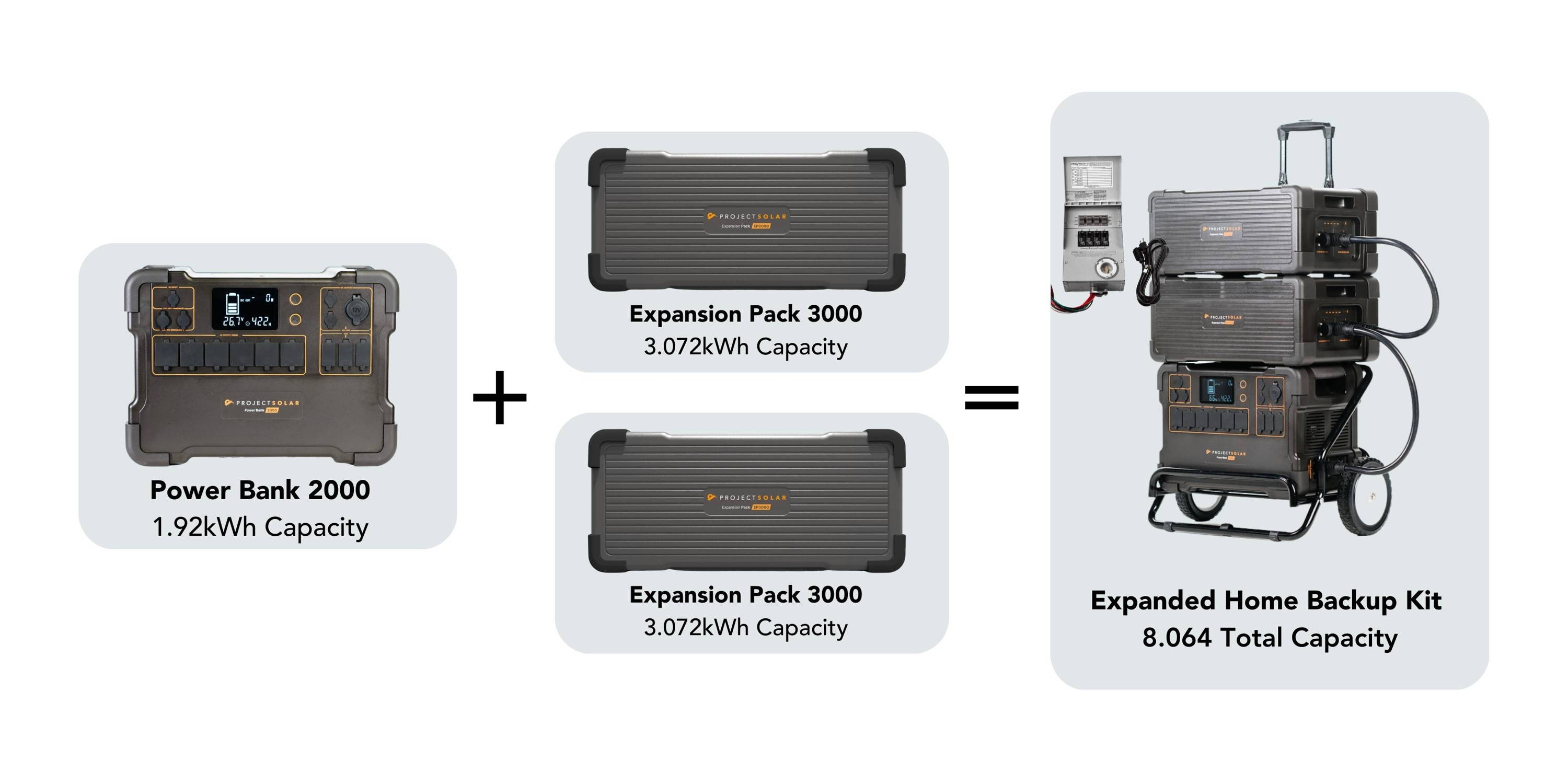

The Power Bank 2000 can be expanded up to 8.064kWh with 2 Expansion packs.

The Power Bank 2000 alone has a capacity of less than 3kWh (at 1.92kWh), but this kit also includes at least one Expansion Pack 3000, bringing the total capacity to 4.992kWh. Customers can purchase and connect an additional Expansion Pack 3000 as well, bringing total capacity to 8.064kWh.

Without at least one Expansion Pack, the Power Bank 2000 does not meet the minimum capacity requirements outlined above.

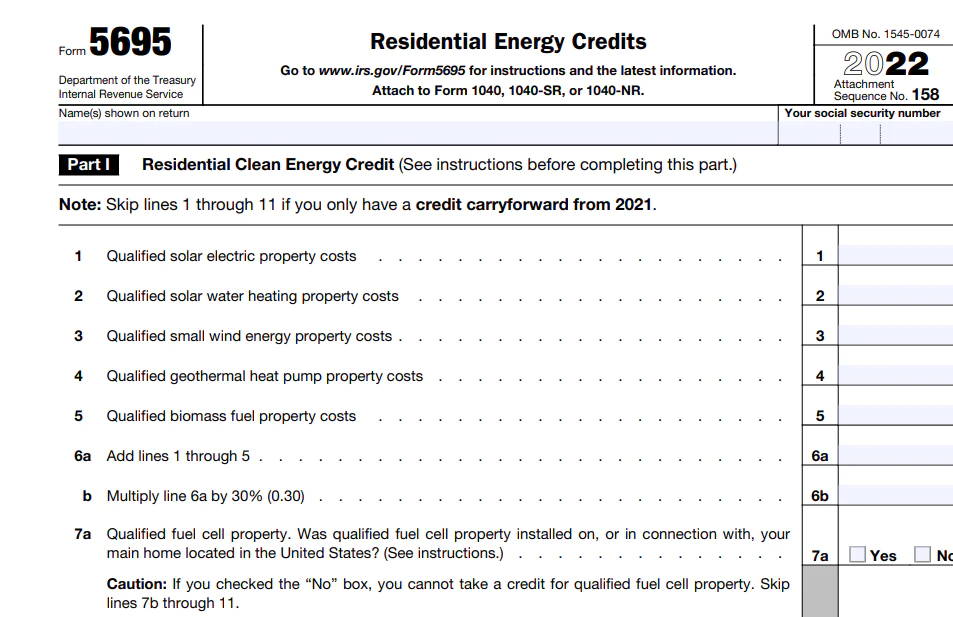

Form 5695, "Residential Energy Credits"

To claim the tax credit, you must file IRS Form 5695, "Residential Energy Credits", with your taxes.

This credit is non-refundable, meaning that it will offset your tax liability. If the credit exceeds your tax liability, you won't receive a refund for the excess amount, though any unused credit can be carried over to future years.

As always, Project Solar always recommends consulting a tax professional for full information and to determine your eligibility for tax credits. We do not offer tax advice.